The Day Trading Mentoring Group

Daily Chat via WhatsApp

Weekly Group Call via Zoom

All 100% Free

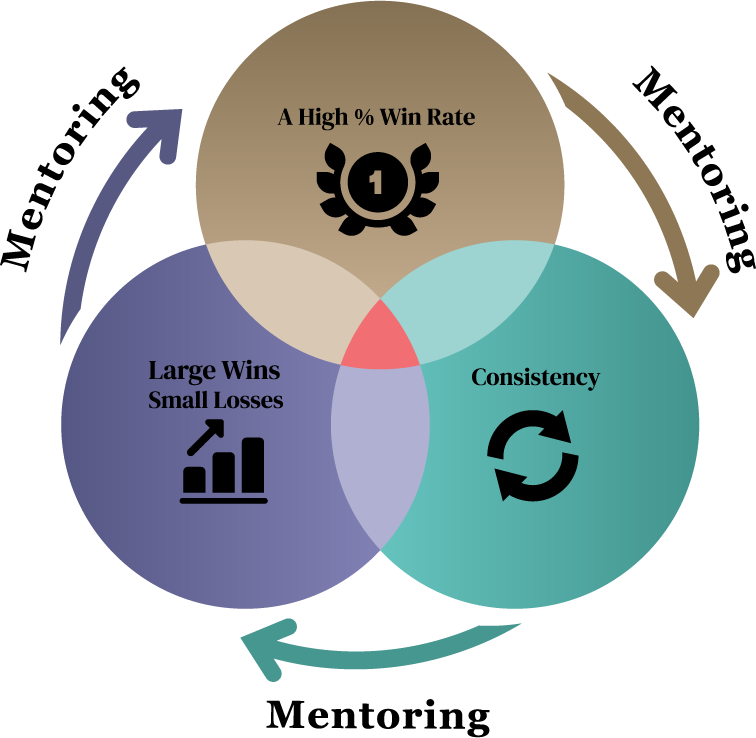

A High % Win Rate

Large Wins Small Losses

Consistency

Progress and growth

Profitability

freedom,

success

How it works

The Road To Profitability

To achieve profitability, understanding the importance of a reasonable win rate, larger wins smaller losses, and consistency are all critical.

Daily hard work in the form of studying our playbook, analyzing our recent wins and losses, and problem solving our weak areas all help us here.

To further bolster our efforts, here is a Daily WhatsApp Group, combined with a Weekly Online Group Mentoring Session via Zoom, to help us discuss and solidify our learnings.

Study and excel

In day trading, continuous studying and analysis are crucial.

Getting super good at technical analysis and reading the charts is a vital component to our profitability.

Furthermore, using excel is an invaluable tool to help us track our data and refine our approach.

Practice

Practice is a fundamental component of success in any skill, and this is also true for day trading.

Daily hands-on experience in front of the charts is essential.

This continuity helps us steadily progress to confidence via competence.

Review Your Trades

Regularly reviewing our trades is a critical aspect of a successful trading routine.

This reflective process allows us to assess our performance, identify our weak areas, and develop our strategy.

By maintaining a trading journal and recording each trade, we gain valuable insights into what works and what doesn’t.

The Journey

Your TimeLine

Months 1-2

In the first two months of our group collaboration, we’ll get to know each other, and focus on taking huge action in the form of studying, practicing, and reviewing.

Months 3-4

By months 3-4 through continuous efforts, we’ll begin to slowly build better decision making, have less red and more green days, and will be slowly turning the tide towards profitability.

Months 5-6

Out of the 22 trading days each month, there really are only 3-6 days which provide HOME RUN trades, and as such by months 5-6 we have learnt to lower our expectations, trade less, and keep hold of our profits.

Months 7-8 and beyond

At this stage, we understand that day trading really is 70% psychology, we have a solid pre-market routine, and our results show much more consistency. Here we start to slowly scale up our size towards achieving larger green days – $100 a day, $200 a day, $500 a day and beyond!

Free Podcast

For all trader types

The Profitability Podcast

Oscar explains the my trading mentoring methodology that support you toward your dream body transformation. Extensive talks about overcoming the genuine barriers to profitability, the professional tricks to getting in shape, and staying motivated throughout the process and much more.

all this is achieved through the

100% free Mentoring Group

TO JOIN: Get In Contact

HOW DO WE IMPROVE OUR DAY TRADING?

Studying and Excelling in Trading:

- Daily Videos: Watch trading videos for an hour daily to stay informed on strategies.

- Rule Reinforcement: Convert trading to audio and listen daily for reinforcement.

- Playbook Review: Spend 30 minutes daily reviewing your playbook to stay sharp.

- Trade Analysis: Record / review trades regularly to identify improvement areas.

Practice:

- Daily Practice: Commit to daily practice to build consistency.

- Checklist: Follow a detailed checklist for each session.

- Psychology: Focus on managing emotions, as trading is 70% psychology.

- Continuous Improvement: Always seek to refine your strategies.

Review:

- Video Repetition: Continuously play trading videos to reinforce learning.

- Weekly Calls: Join weekly mentoring calls for insights.

- Homework: Complete assignments to apply learning.

- Accountability: Partner with others to stay accountable.

Recent Trades

Here is a recent winner